Project Electric

After three decades of steady growth and strong regional relationships, the owner of a respected electrical contracting firm was ready to step away from the business. With a team in place, a solid brand identity, and deep ties to general contractors across the Midwest, the company had become a go-to partner for multi-family, hotel, and high-end residential projects.

To find a buyer who would value both the company’s legacy and its long-term potential, the owner partnered with True North Mergers & Acquisitions.

Rising demand for new housing and renovations, combined with favorable industry forecasts, made this a prime time to explore a sale.

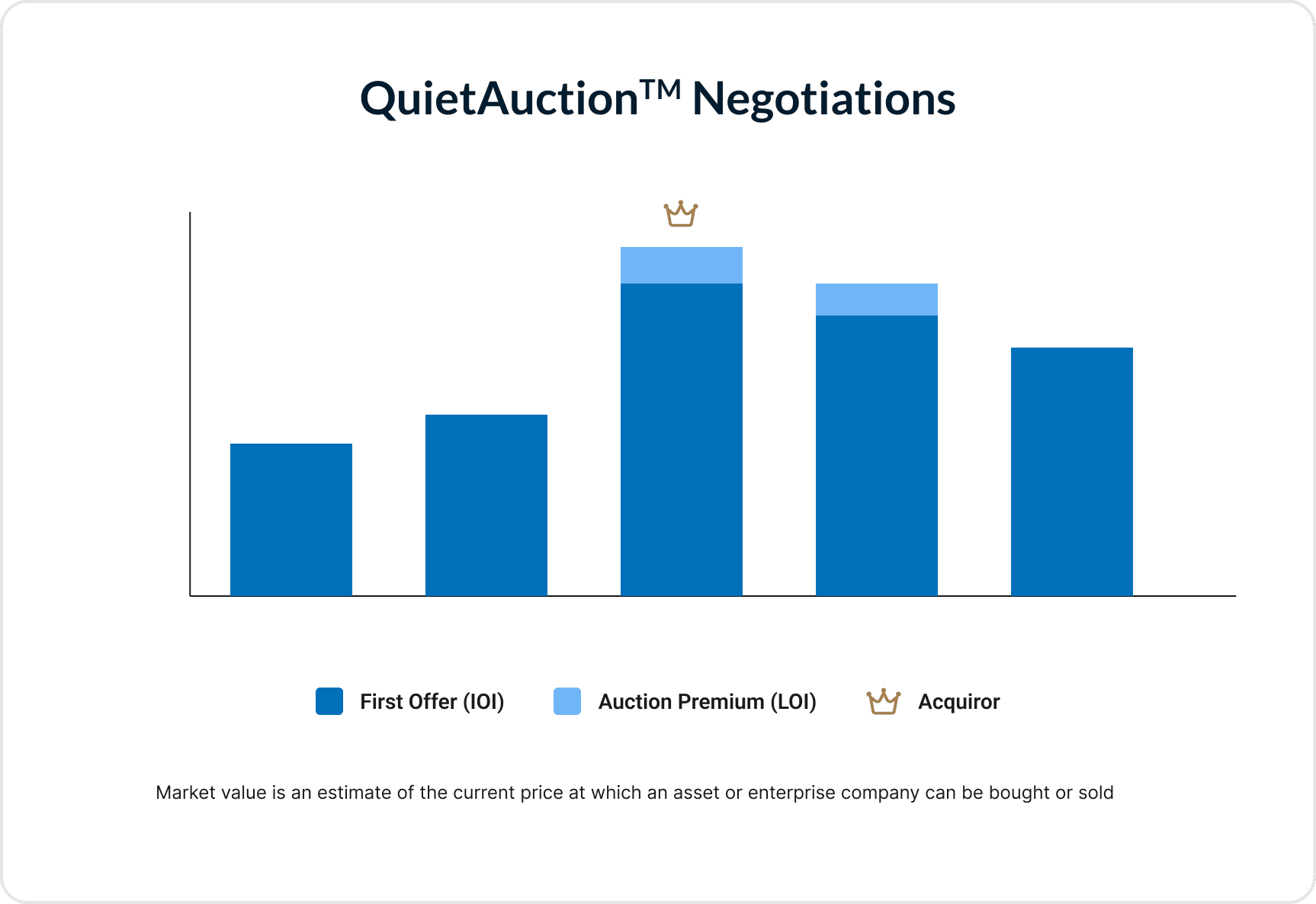

Through our QuietAuction™ process, we identified a strategic buyer with a complementary service offering and a shared commitment to quality. The deal positioned both companies for growth while ensuring continuity for both employees and customers.

TNMA’s deal team and advisor conducted extensive research into the electrical contracting space and found:

- The U.S. market includes over 75,000 businesses and generates more than $170 billion annually

- Industry revenue is projected to reach $283.74 billion by 2028, growing at a CAGR of 3.94%

- Post-pandemic demand for new housing, office space, and renovations was driving sustained growth

- The sector continues to attract strong interest from private equity and strategic buyers

Our client stood out with:

- A trusted brand built over 30+ years

- Comprehensive services across residential and commercial sectors

- Strong customer loyalty and a growing pipeline of signed contracts

Throughout the process, the seller emphasized the importance of employee care and cultural fit. We led with those values in our outreach plans while leveraging competitive interest to strengthen negotiating power. The buyer, an HVAC business with a growing regional presence, recognized the opportunity to expand its service portfolio by adding electrical services.

We compiled detailed marketing materials that highlighted the company’s history, regional reputation, and ongoing opportunities. Our goal: position the business as a vehicle for strategic growth.

Using our QuietAuction™ process, we generated multiple indications of interest and two letters of intent. The seller was focused on finding a buyer who would retain the existing team and uphold the company’s culture.

During the due diligence phase, our team worked closely with both parties to ensure a smooth transition—one that would protect the agreed terms.

While the seller’s top priority was finding a buyer with the right cultural fit, we did not leave deal value on the table. By leveraging favorable market trends and using our Compass Exit Opinion process, we created competitive pressure that supported a strong deal. The final buyer offered more than capital—they shared the company’s values, saw its strategic potential, and had a clear plan to grow the business.

The transaction united two companies with shared services and values. Equally important, the seller exited on their terms, and the buyer gained a proven electrical contracting team to expand their service offerings.