Project Steel

After more than a decade serving complex sectors like oil, gas, and power generation, the owners of a certified welding and fabrication company were ready to sell. With a strong track record, advanced capabilities—including robotic welding, CNC plasma, and large-scale machining—and a team of highly skilled employees, the business had carved out a respected position in the market.

But the owners of Project Steel weren’t just looking for any buyer. They wanted someone who understood the business, appreciated the legacy they’d built, and could keep things running without disruption. That’s where True North Mergers & Acquisitions came in.

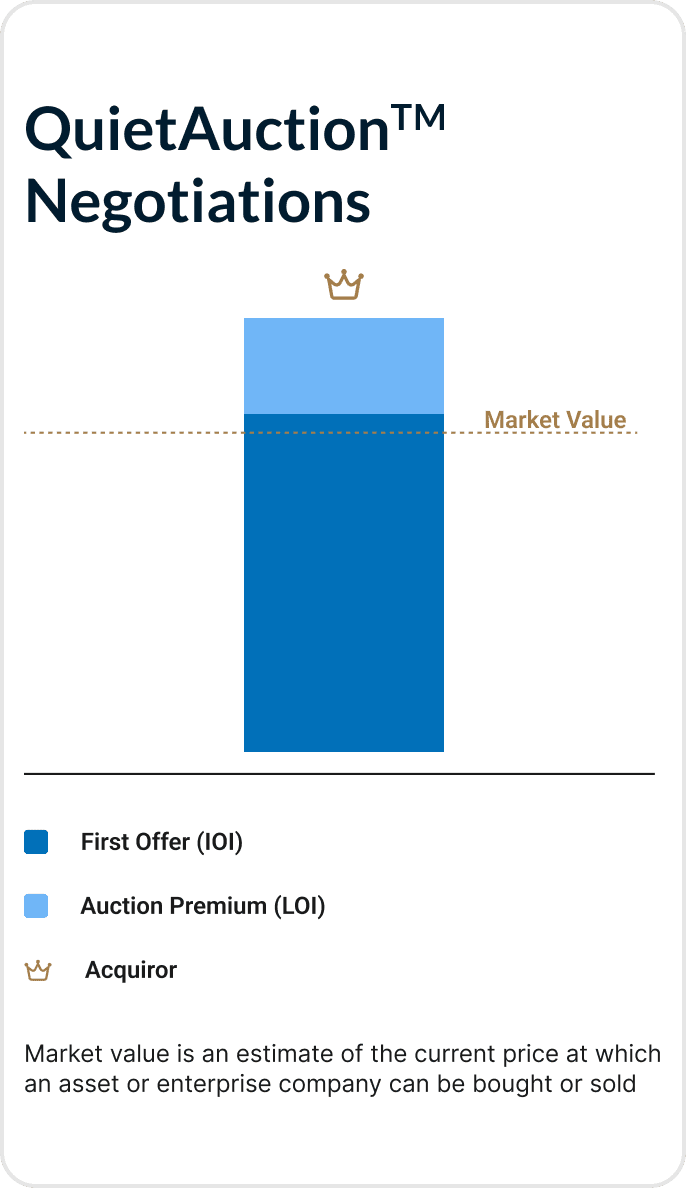

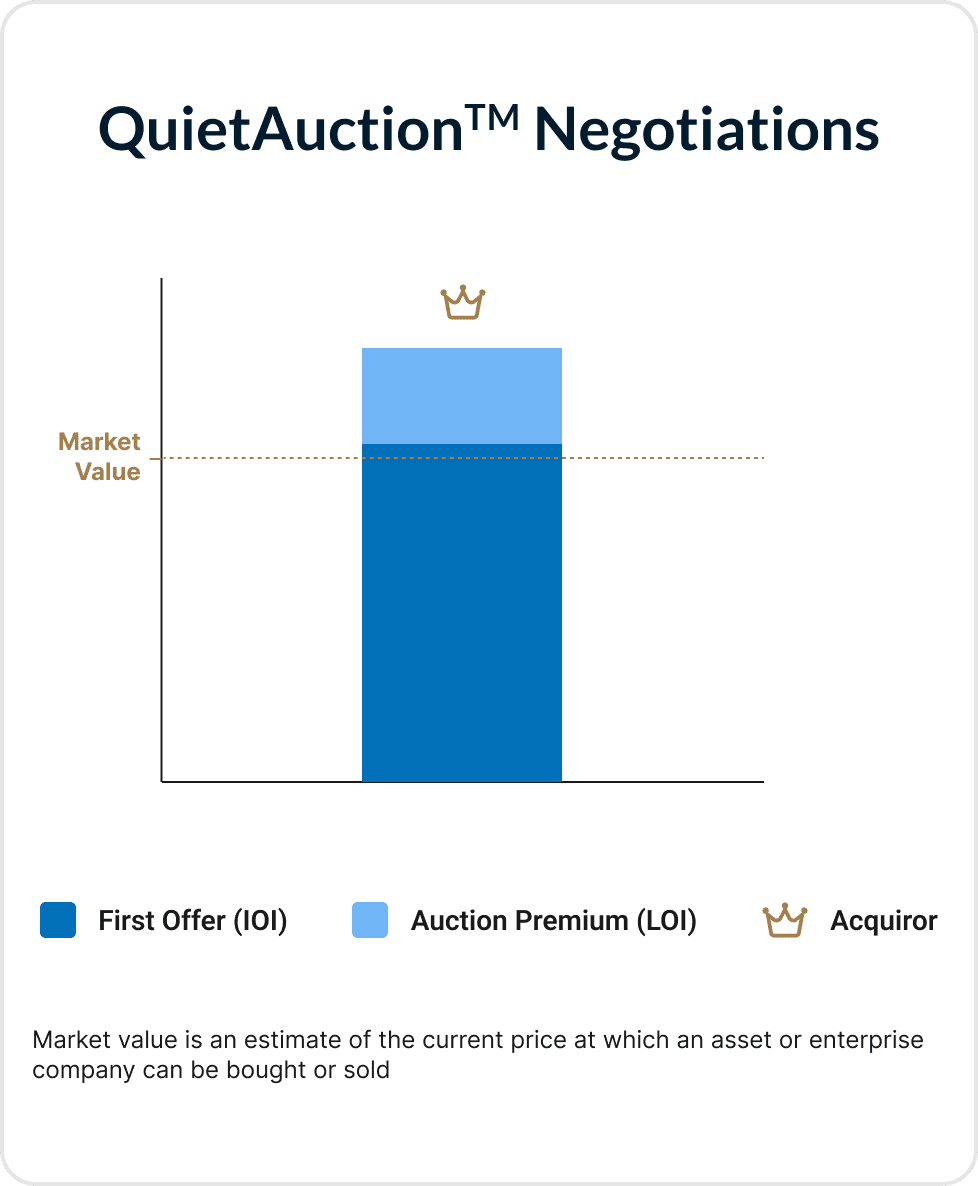

We moved fast—preparing the business for market, running our QuietAuction™ process, and guiding both parties through a successful sale in just 120 days. And we did it while protecting jobs, preserving the company’s identity, and positioning the buyer for future expansion.

Our team conducted extensive research into the industrial welding and manufacturing space. Here’s what we uncovered:

- The oil and gas sector was rebounding, creating fresh demand for pressure vessels, tanks, and custom components.

- Project Steel’s ASME certifications, offshore/onshore capabilities, and technical capacity made it a strong fit for that growth.

- The heavy equipment manufacturing sector is expanding, with opportunities to serve top-tier clients

The owners made it clear: the timeline mattered, but so did the outcome. They wanted to find the right buyer, not just the first one. We focused on buyers with industrial expertise and capacity needs, and quickly identified a strategic fit. The buyer was looking to enter the welding and fabrication space and saw Project Steel as the right platform to do it.

The business owner had a tight timeline for selling the business. To address this, they worked with True North M&A to adequately prepare for entering the market.

With the assistance of TNMA’s team and their three-phase QuietAuction™ process, the team identified qualified buyers and facilitated the M&A process efficiently.

TNMA conducted due diligence and successfully facilitated the deal within 120 days. This achievement not only preserved the family legacy but also ensured that over 40 families retained their jobs.

Despite the compressed timeline, we didn’t compromise on outcomes. Through our Compass Exit Opinion (CEO) process, we created competitive leverage and guided the seller toward a buyer with operational synergies and long-term vision. The final deal preserved the company’s core team while providing the buyer immediate capacity and certified labor to drive growth.

The acquisition gave the buyer a foothold in a new market—and the tools to scale quickly. For the seller, it meant protecting a family legacy, preserving over 40 jobs, and completing a clean transition in just four months. The result was a strategic win on all sides.