Compass Exit Opinion

Unlock Your Company's Full Value

True North Mergers & Acquisitions Compass Exit Opinion™ (CEO) is designed to provide you with essential financial insights, research, and data as you navigate the options and timing of a potential ownership transition.

As a successful entrepreneur, you've spent countless hours building your company. TNMA understands the significance of your life's work and respects it deeply. We view the sale of your company as a life-changing project that requires a professional M&A deal team to manage the process.

When you're ready, our TNMA team will work with you to maximize your company's marketplace value, protect your legacy, and ensure a smooth transition as you and your company strategically move to the next phase of ownership. We are committed to helping you achieve your financial and life goals.

Compass Exit Opinion™: Your Roadmap to Maximum Value

Our Compass Exit Opinion™ is a comprehensive examination of your company's recent financial history and position in the competitive industry. It provides a clear path forward by offering data and professional guidance to help you achieve your desired outcome.

Our analysis uncovers the same data points that sophisticated buyers consider in their acquisition thesis. The CEO delivers a market-based opinion of your company's current value, suggests ways to enhance your company's appeal, and shares research on industry-specific trends and related M&A activity. It also outlines potential deal structures to minimize tax consequences and maximize cash, identifies which assets and liabilities will be included and excluded, and presents scenarios that enable creative financing options.

This approach broadens the pool of potential acquirers, increasing the amount they are willing to pay in our competitive QuietAuction™ bid process.

Maximizing Value

One of the primary objectives of the Compass Exit Opinion™ is to create a roadmap that maximizes the value of your business, whether you want to transition from it in the short term or leave it thriving for future generations of leaders and family members through unique insights.

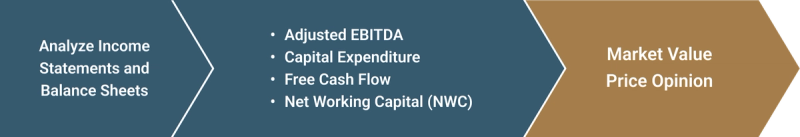

Our team is dedicated to understanding and meeting your needs, delving into the company's financials thoroughly, and analyzing income statements and balance sheets to determine Adjusted EBITDA, capital expenditure, free cash flow, and net working capital (NWC), among other financial and operational insights. We use this data to perform a "Market Value Price Opinion" or what a buyer might be willing to pay for the company in the current capital markets.

Receiving the highest price for your company is only one piece of a complex M&A puzzle. Negotiating the best terms allows the sale price to generate absolute value since the terms will directly affect the tax consequences and the amount of net cash as part of the proceeds.

Transaction Options, Deal Structure Terms, and Proceeds Analysis

The Compass Exit Opinion™ guides the strategy to find the right buyer to close the transaction and ensure a smooth ownership transition, minimizing disruption to business operations. Our approach is also a crucial strategy for the continuity of the business and the enhancement of its value and legacy by illustrating deal structure options for potential internal and external buyers.

Net After-Taxes (NAT) Proceeds Analysis

We focus on transaction terms that allocate the assets you keep, liabilities you need to assume, and those that are part of the transaction, while considering tax efficiency scenarios. This analysis assists you and your wealth management advisor, a key part of our team, in successfully planning the next steps in your life, ensuring that the financial aspects of the transition are managed effectively and providing you with peace of mind and a clear financial plan for the future.

Frequently Asked Questions

Let our elite team of advisors guide you towards a better solution for your financial future.

It’s Our Culture That Makes Us Different

We Take Action

Our professional advisors bring perseverance, problem-solving, and a “get it done” attitude to the table.

Our Team Works Hard & Plays Hard

We balance a strong work ethic that brings profitable results to our clients within a culture that celebrates the process.

We’re Leaders In More Ways Than One

At True North Mergers & Acquisitions, we’re a leader to our clients, a leader in the marketplace, and leaders to each other.

We Believe in Teamwork

We bring our whole selves and work as a team to deliver world-class service to our clients.

Help People First & Success Will Follow

We’re devoted to encouraging, equipping, collaborating and uplifting all who come in contact with us.

It’s All About Servant Leadership

This is the core purpose of why we exist — placing the needs of others before ourselves. Success will follow.

Our Advisors Bring You Expertise, Market Knowledge & Industry Contacts

Meet the people of True North Mergers & Acquisitions — a team of high-caliber advisors and industry experts who will rally for you.

$10M - $250M

TYPICAL TRANSACTION SIZE

30+ M&A

PROFESSIONALS

$4B+

TRANSACTIONS CLOSED

$120M

LARGEST TRANSACTION

300+ Years

COMBINED ADVISORY EXPERIENCE

What Our Clients Say About Partnering With Us

Our advisors’ decades of experience, market knowledge, and industry expertise have proved invaluable to our clients. Here’s what they say about working with the True North Mergers & Acquisitions team.