An Exit Strategy Tailored To Your Goals & Objectives

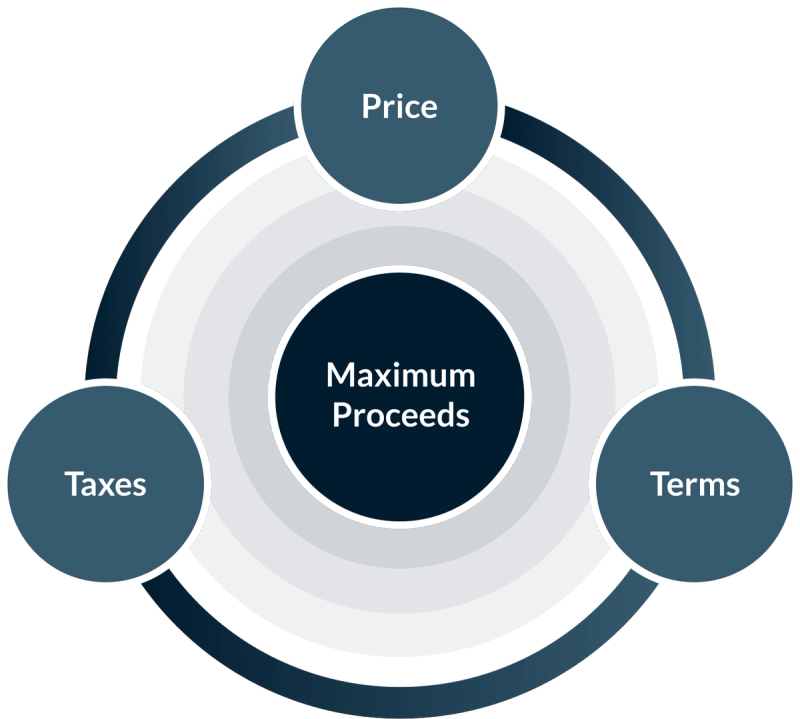

Of course, the “price” or enterprise value is essential when planning your exit after selling the company. But what you “net” after taxes and fees really matters.

Deal Terms That Work in Your Favor

Selling your company should be viewed as a project rather than just an event. Our sell-side M&A advisory team understands transaction negotiations' price, terms, and tax implications and how they impact you long after the deal closes.

Along with the price, our M&A team focuses on the "terms" of the transaction. Negotiating seller-friendly terms is a skill in an M&A transaction. Having an M&A transaction strategy that concentrates on terms to increase the total consideration of the sale value and mitigate taxes is an art.

Price, Terms, and Taxes

Understanding Transaction Negotiations

Price

The TNMA deal team understands that purchase price is only one piece of a complex M&A puzzle. Aside from price, there are other essential factors to consider:

- Your involvement in the sale

- Company reputation and legacy

- Culture and employee morale

Terms

The terms in an M&A transaction significantly influence the deal's outcome by maximizing cash as part of the proceeds, and net-after-tax consideration. Several levers can be pulled in structuring the optimal transaction, including ownership’s goals, company’s growth, and tax-efficiency strategies.

Taxes

The old cliche “it’s what you keep that matters” is the primary focus for the TNMA deal team. We understand how to navigate different tax structures and their complexities. Typically, the best deal structure favors one party over the other. Negotiating the transaction’s tax structure can get complex quickly, so we work with your tax advisor to formulate the optimal tax allocation strategy that favors you.

- The business structure of buyer and seller (C-Corp, S-Corp, LLC)

- The deal structure (cash, equity, earnout, debt)

- Location of the deal (state and local taxes vary)

Let our elite team of advisors guide you towards a better solution for your financial future.

It’s Our Culture That Makes Us Different

We Take Action

Our professional advisors bring perseverance, problem-solving, and a “get it done” attitude to the table.

Our Team Works Hard & Plays Hard

We balance a strong work ethic that brings profitable results to our clients within a culture that celebrates the process.

We’re Leaders In More Ways Than One

At True North Mergers & Acquisitions, we’re a leader to our clients, a leader in the marketplace, and leaders to each other.

We Believe in Teamwork

We bring our whole selves and work as a team to deliver world-class service to our clients.

Help People First & Success Will Follow

We’re devoted to encouraging, equipping, collaborating and uplifting all who come in contact with us.

It’s All About Servant Leadership

This is the core purpose of why we exist — placing the needs of others before ourselves. Success will follow.

Our Advisors Bring You Expertise, Market Knowledge & Industry Contacts

Meet the people of True North Mergers & Acquisitions — a team of high-caliber advisors and industry experts who will rally for you.

$10M - $250M

TYPICAL TRANSACTION SIZE

30+ M&A

PROFESSIONALS

$4B+

TRANSACTIONS CLOSED

$120M

LARGEST TRANSACTION

300+ Years

COMBINED ADVISORY EXPERIENCE

What Our Clients Say About Partnering With Us

Our advisors’ decades of experience, market knowledge, and industry expertise have proved invaluable to our clients. Here’s what they say about working with the True North Mergers & Acquisitions team.